(The Hill) – The Trump administration is moving rapidly to gut the Consumer Financial Protection Bureau (CFPB), halting the agency’s work, cutting off its funding and shutting down its headquarters.

The push is not unlike the effort launched in the early years of President Trump’s first term to defang the agency, which has faced staunch opposition from Republicans throughout its brief existence.

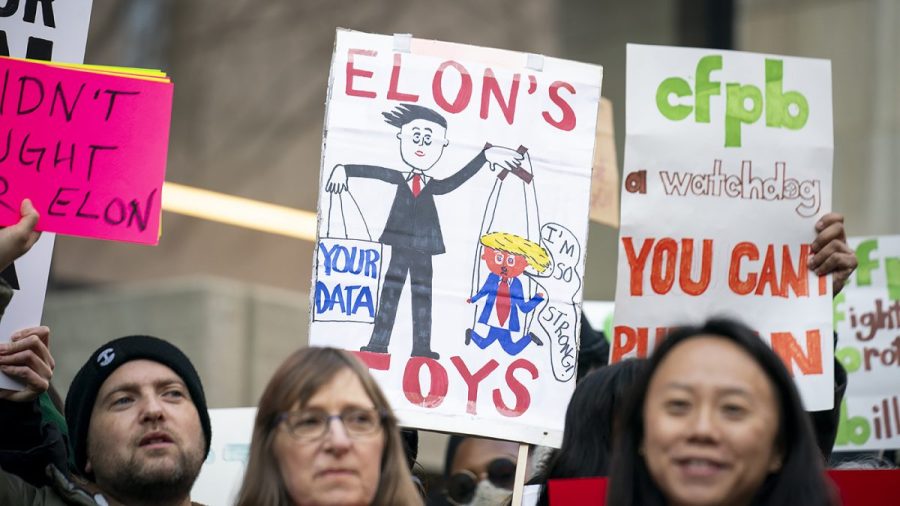

However, as Elon Musk’s Department of Government Efficiency (DOGE) sweeps into one agency after another with the directive to slash wide swaths of government funding, the new assault on the CFPB has sparked concerns from consumer advocacy groups and Democratic lawmakers about just how far the administration will go this time.

“I think everyone assumes this is the USAID playbook, and I think everyone’s operating off of the assumption that we’re about to get annihilated, the way that they were annihilated,” a CFPB employee told The Hill, referring to the U.S. Agency for International Development.

The moves at the CFPB have drawn parallels with USAID, where staff were also told to stay out of headquarters and cease work before the Trump administration attempted to place thousands of employees on administrative leave. The effort was put on hold by a federal judge Friday night.

“There is precedent for certain action, for certain ways in which they took CFPB off the beat during the first Trump administration,” said Graham Steele, former assistant secretary of financial institutions at U.S. Treasury under President Biden.

“The idea of trying to basically shut the agency down in all but name is a step farther,” he added. “It’s an escalation.”

The Trump administration launched its blitz attack on the agency over the weekend, shortly after newly confirmed Office of Management and Budget (OMB) director Russell Vought was appointed acting CFPB director on Friday.

He took the place of Treasury Secretary Scott Bessent, who had been named acting director just days earlier. Bessent had reportedly directed staff to halt work on enforcement actions, rulemaking and litigation.

Vought similarly ordered employees to “cease all supervision and examination activity” and “stakeholder engagement” on Saturday, according to The Washington Post. That same day, he announced he would not take its next drawdown of funding from the Federal Reserve.

“The Bureau’s current balance of $711.6 million is in fact excessive in the current fiscal environment,” Vought wrote in a post on X. “This spigot, long contributing to CFPB’s unaccountability, is now being turned off.”

The agency’s chief operating officer, Adam Martinez, reportedly told staff Sunday that its headquarters would be closed for the week. On Monday, Vought ordered employees to “stand down from performing any work task,” according to Business Insider.

The CFPB’s X account has since been deleted, and the homepage of its website shows a note that says “404: Page not found,” although the site remains functional.

Employees affiliated with Musk’s DOGE have also gained access to CFPB’s data systems, according to Bloomberg News. Despite initially receiving limited access, they now have access to the full scope of information stored at the agency, including sensitive bank examination and enforcement records.

Sen. Elizabeth Warren (D-Mass.), the top Democrat on the Senate Banking Committee, slammed Musk and Vought in a video posted to X on Monday for attempting to “kill” the CPFB, calling it “another scam.”

Eric Adams to address media as DOJ orders charges to be dropped

“So why are these two guys trying to gut the CFPB?” Warren asked. “It’s not rocket science: Trump campaigned on helping working people, but now that he’s in charge, this is the payoff to the rich guys who invested in his campaign and who want to cheat families — and not have anybody around to stop them.”

Rep. Maxine Waters (D-Calif.), ranking member of the House Financial Services Committee, took aim at Musk in particular.

“Why the richest man in the world is working to gut the agency that has returned $21 billion to harmed American consumers is simple,” she said in a statement Saturday.

She pointed to the billions of dollars’ worth of government contracts held by Musk’s companies, as well as his plans to turn his social platform X into a digital payment platform.

“Such a platform would be regulated by — you guessed it — the CFPB,” Waters said. “So, in addition to having access to the consumer data of millions of Americans, Musk can now illegally steal sensitive business information about other American companies in the same industry. It doesn’t get any more corrupt and anti-American than that.”

Musk’s large network of companies, including Tesla, SpaceX and X, have increasingly raised questions about conflicts of interest, particularly as his DOGE team burrows into every part of the executive branch.

DOGE-affiliated employees have rapidly moved from one agency to the next, with a focus on gaining access to technological infrastructure.

At the Treasury Department, DOGE staff received access to a sensitive federal payment system, sparking outcry from Democrats and prompting several lawsuits. A federal judge ultimately blocked Musk and his DOGE team from accessing the system late Saturday.

The National Treasury Employees Union filed two separate lawsuits against Vought over the CFPB push Sunday. The first case seeks to prevent the push to dismantle the agency, while the other seeks to block DOGE’s access to CFPB employees’ personal information.

The Trump administration’s efforts to target the CFPB are not entirely surprising, given the GOP’s history with the agency.

“It’s no surprise that there was going to be an interest in trying to effectively gut the CFPB, one way or another, pretty early on into the Trump administration,” Steele said. “The CFPB has been the bête noir of conservatives for a long time.”

Conservatives have opposed the CFPB since its creation in 2010, in the wake of the 2007-08 financial crisis. They argue the agency has overstepped its regulatory authority and the bounds of the Constitution, and have frequently leveled such arguments against the CFPB in court, without much success.

As the CFPB cannot be eliminated without an act of Congress, appointees in Trump’s first administration set about attempting to limit the agency’s power.

Former OMB director and acting CFPB director Mick Mulvaney instituted a freeze on hiring and new rulemaking when he took control of the agency in 2017. Much like Vought, he also requested a budget of zero dollars from the Fed.

“This is a déjà vu situation,” said Joe Lynyak, a financial services partner at the law firm Dorsey & Whitney. “But I would say that Mr. Vought is probably a more astute tactician in terms of his utilization of authorities.”

DHS seeks to deputize IRS agents to help with deportation efforts

In the second Trump administration, they have taken things a “step farther,” in a way that could expose them to lawsuits if they fail to fulfill certain statutorily required duties, Steele said.

“I think it is a more dramatic shift that raises some of these core legal questions about the separation of powers, Congress telling agencies what to do and the agencies faithfully executing the laws, which is what they’re supposed to be doing,” he told The Hill.

Lynyak warned that the push to effectively dismantle the CFPB could be met “more forcefully” than the response to the DOGE’s efforts to shutter USAID.

“If the CFPB is effectively defunded and prevented from standing up for consumers, the consequences could be severe,” Delicia Hand, senior director, digital marketplace at Consumer Reports, said in a statement.

“Consumers will end up paying the price if the CFPB is sidelined and will be more likely to fall victim to predatory practices, hidden fees, and data privacy violations,” she continued. “Without an active cop on the beat looking out for consumers in the financial marketplace, the administration is essentially saying consumers are on their own.”